Intermarket Analysis: Connecting Forex with Stocks, Commodities, and Bonds

Intermarket analysis examines the relationships between different asset classes—Forex, stocks, commodities, and bonds—to identify correlations and improve trading decisions. By understanding these connections, traders can anticipate market movements and develop strategies based on macroeconomic trends.

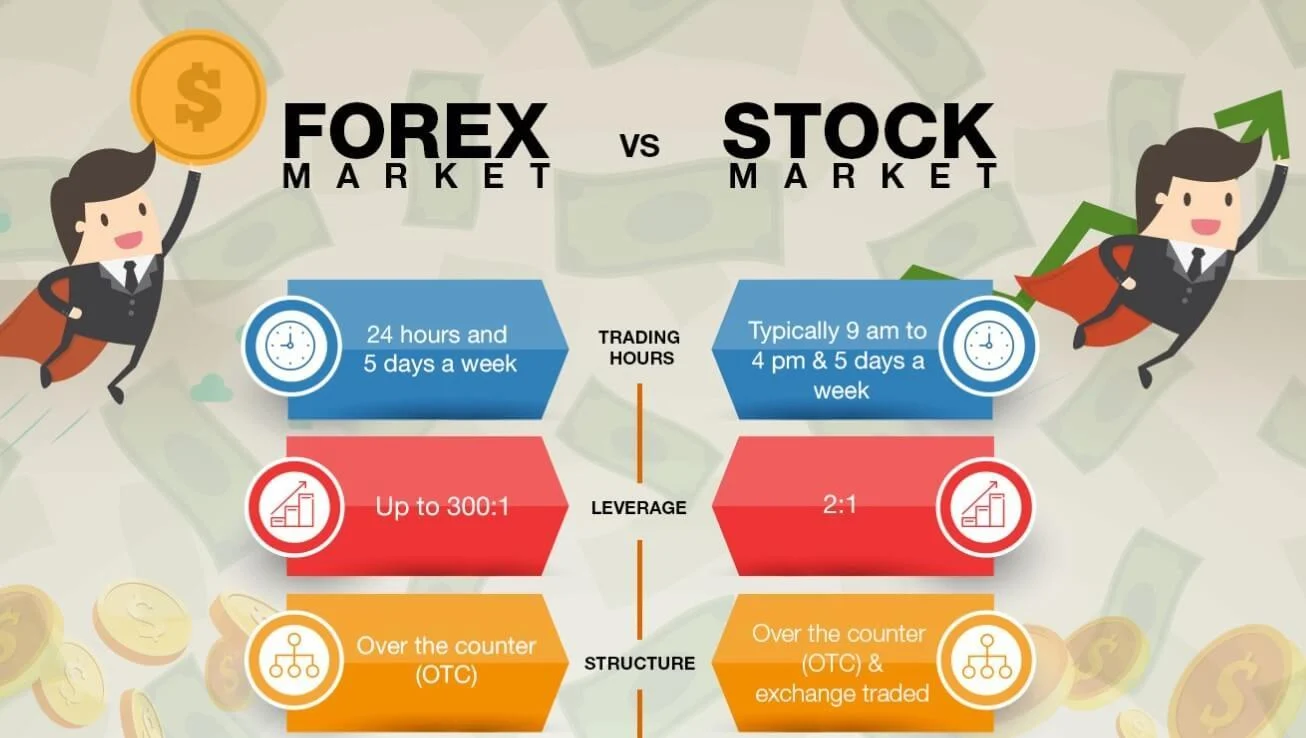

The Relationship Between Forex and Stocks

Forex and stock markets are interconnected, with currency fluctuations impacting equity markets and vice versa. A strong domestic currency can hurt export-driven companies by making their goods more expensive abroad, potentially weakening stock indices. Conversely, a weaker currency can boost exports and support equity markets. Additionally, stock market performance influences investor sentiment, which can drive capital flows into or out of a country’s currency.

Commodities and Forex: A Symbiotic Relationship

Commodities like gold, oil, and agricultural products have significant impacts on currency valuations. Commodity-exporting countries, such as Canada (oil), Australia (iron ore), and New Zealand (dairy), see their currencies closely linked to commodity price fluctuations. For example, rising oil prices often strengthen the Canadian dollar (CAD), while falling prices weaken it. Gold prices also have a strong inverse correlation with the U.S. dollar (USD), as investors flock to gold as a safe-haven asset when the dollar declines.

Bonds and Forex: The Role of Interest Rates

The bond market plays a crucial role in Forex movements, as interest rate differentials between countries impact currency demand. Higher bond yields attract foreign capital, strengthening the currency, while lower yields can lead to depreciation. Traders often monitor government bond yields, such as U.S. Treasury yields, as they provide insights into interest rate expectations and global risk sentiment. A rising U.S. bond yield typically strengthens the USD, while falling yields weaken it.

Using Intermarket Analysis in Trading Strategies

- Monitor Global Correlations: Understanding the interplay between asset classes helps traders predict currency movements more effectively.

- Identify Risk-On vs. Risk-Off Sentiment: During risk-on periods, stocks and risk-sensitive currencies (AUD, NZD, CAD) tend to rise, while in risk-off environments, investors move to safe-haven assets like the USD, JPY, and gold.

- Watch Commodity Trends: Tracking commodity prices can provide early signals for currency strength or weakness, especially for commodity-linked currencies.

- Follow Bond Market Movements: Interest rate expectations, reflected in bond yields, can indicate future Forex trends and guide trading decisions.

Intermarket analysis is a powerful tool for Forex traders, offering valuable insights into macroeconomic trends and asset class correlations. By understanding how stocks, commodities, and bonds influence currency markets, traders can enhance their strategies and make more informed decisions in an interconnected financial landscape.